Savings are growing in importance in personal fiscal strategies, and CDs are coming to the forefront. A CD, or a share certificate of deposit, is a special savings account or investment. A CD earns you higher dividends than an average savings account because you agree to the financial institution holding onto your money for a set term. At the end of the term, or its maturity, your deposit is returned with the interest earned. Generally, the longer the term, the higher the interest rate, which translates into more dividends. However, the longer the term, the longer your funds are unavailable for other uses, or for moving into higher yielding accounts.

CD deposits are not entirely inaccessible, but withdrawing your deposit early may result in a penalty, making it inadvisable to do so except for emergencies or if a new rate elsewhere will earn more than the penalty. However, you can use a CD ladder to increase your earnings while providing flexibility. CD laddering is a method of structuring multiple CDs to provide you with regular access to your savings while earning the highest interest available.

How to Build a CD Ladder

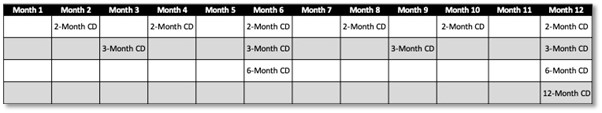

By investing your funds into CDs with different terms like 2 months, 3 months, 6 months, and 12 months, you have built a CD ladder. With CDs maturing at different times, you create a staggered or ladder effect. When opening your CD accounts, you will choose whether the balance will roll over into the same term account, be deposited into your regular checking or savings, or roll into a different CD account. Therefore, you can use this strategy for a set period or until you need the money.

Take the time to graph out the maturity dates for your CDs. If you have a 2-month CD that matures and rolls over, then it will mature again right after your 3-month CD, and the next time at the same time as your 6-month CD. You can see in the chart that there are only a few months when funds are not available for use or re-investing.

What are the Benefits of a CD Ladder?

- Unlike many other types of investments, CDs offer a guaranteed rate of return and are also federally insured, providing more security.

- CDs are relatively simple to manage over stocks or bonds.

- Laddering your CDs is a great way to take advantage of the higher interest rates offered by longer terms while also maintaining a level of liquidity.

- In the case of rising rates, reinvesting into shorter-term CDs locks in those higher APY rates.

- A CD ladder offers flexibility. Expenses can pop up unexpectedly, and you can easily pull money out of CDs if you need it, though you may incur early withdrawal penalties.

What are the Drawbacks of a CD Ladder?

- You trade the opportunity for higher returns from more aggressive investments, like stocks or bonds, for the security offered by guaranteed returns and federal insurance.

- If interest rates are declining, maturing short-term CDs will be reinvested into lower rates.

If you want to learn more about how CDs fit into your portfolio or how to build your own CD ladder, contact us today. We also offer CDs for businesses.